Current market dynamics and industry trends

The start of 2023 has followed the same trends that emerged in 2022, with softer budgets and lower CPMs across the advertising market globally. Factors driving this downturn include rising interest rates, inflation, and slowing global growth.

- There has been a 20% decline in performance digital advertising unit revenues as advertisers tighten their belts in the need for greater efficiencies. This is the first time industry experts don’t expect a year-over-year CPM growth since 20201

- Historically these declines are short-lived. Advertising spend tends to stay within a very narrow range of 1.0 to 1.4% of GDP2

In light of the recent trends, Rokt remains steadfast in investing in the strength of our marketplace so that brands can continue to unleash the potential of their business and drive ancillary revenue through the power of relevancy.

Increasing the strength of our Marketplace

Rokt is hyper-focused on increasing the strength of our marketplace by investing in opportunities that pay back in dividends.

- Rokt has experienced much faster marketplace growth than normal. For the last 6 years, transaction growth has averaged around 50% per annum compound, however this year this is tracking at 40% above this long-term trend. Rokt is becoming a more meaningful part of advertisers’ marketing mix, and often cited as a top 3 channel alongside Search and Social.

- In revenue terms, Rokt is only 0.2 to 0.3% of the global advertising market so we are not big enough to move the market. However, there is a 60 to 90 day cycle when we see rapid growth – like we are at the moment – for budgets and allocations to adjust between the channels. This is having a small additional negative impact in Rokt advertising yields of 3 to 4%. Over a 3 to 6 month cycle we expect this growth to have a 5% positive impact on yields.

- Since January, Rokt has brought on 60 net new brands to the marketplace, including major advertisers and premium ecommerce partners like Lyft, Asos and Newegg.

Investing in R&D

We are investing a lot in R&D to continue to improve long-term outcomes for partners through improving end customer relevancy. Each year this work yields a 3-5% increase in outcomes. This year we will spend close to US$100M in advancing the product. This is also allowing us to bring on more products that provide new opportunities to improve the economics of your ecommerce channels. In particular, our recent expansion of the payments marketplace is a great opportunity for partners to generate a lot more revenue and help offset the cost of payment processing fees.

As we continue to scale, we are always looking to add more value for our partners. We have recently made a few changes to our marketplace and platform terms to provide additional value to partners:

- Engagement campaigns for your own marketing activity can now be run on your own site using the Rokt relevancy platform at no cost

- An expanded channel program that provides partners with easier access to more revenue by getting more involved in the Rokt marketplace – this includes generating a greater revenue share onsite plus a referral bonus offsite for all referred advertisers.

Explore growth solutions from Rokt

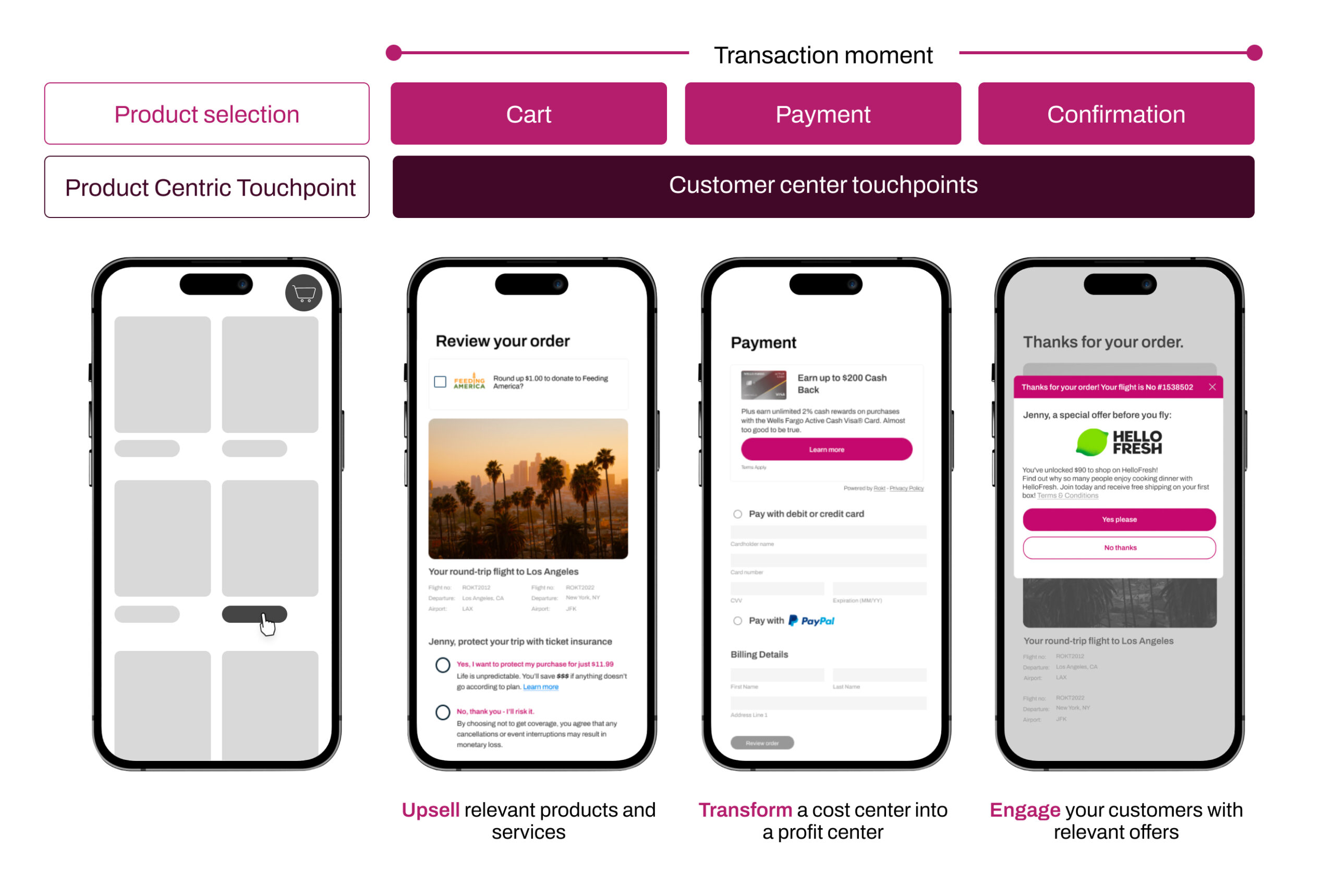

At the core of what we do is the customer and creating the best, most relevant experience in the transaction moment. Through this lens, we continue to introduce new, robust opportunities that improve both short term and long term business value and enable you to achieve your growth goals.

Ready to unleash the potential of your business with Rokt solutions? Talk to an expert.

1Source: AdRoll, “2023 Digital Advertising Outlook,” February 13, 2023

2Source: Bloomberg, “Advertising’s Century of Flat-line Growth”, March 3, 2023